The relevant proposals from an individual tax perspective are summarized below. This personal income tax calculator will work out tax rates obligations and projected tax returns and also tax debts for certain cases.

Income Tax Malaysia 2018 Mypf My

If youre a non-resident taxpayer the system is a little more straightforward - but also more expensive.

. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. 2018 titled Taxation of a Resident Individual Part II - Computation of Total Income and Chargeable Income the next step is to compute the income tax charged and the income tax payable by an individual or tax repayable to the. Source 17 December 2017 What are the tax exemptions in Malaysia.

When to Use This Calculator Once you know what your total taxable income is You want to work out the tax on that taxable income. The tax relief for year 2018 folder_open Tax Relief for Individual. Technical or management service fees are only liable to tax if the services are rendered in MalaysiaWhile the 28 tax rate for non-residents is a 3 increase from the previous years 25.

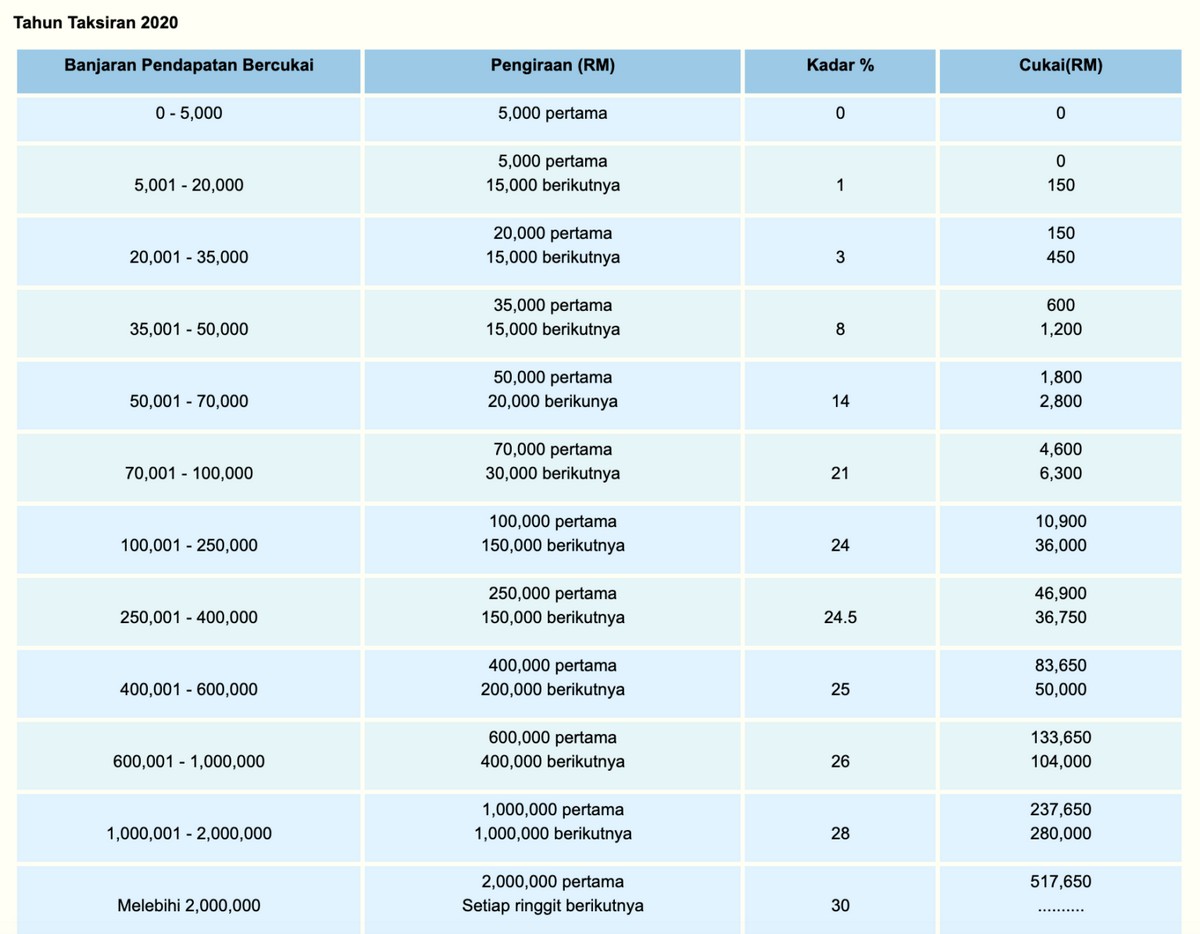

Some items in bold for the above table deserve special mention. Calculations RM Rate TaxRM 0 - 5000. Poring over your finances from last year probably wont be fun but at least youll know you can get the highest tax refund back possible.

Personal Income Tax 20182019 Malaysian Tax Booklet 22 Rates of tax 1. Individual Life Cycle. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent. Income Tax Table 2018 Malaysia masuzi December 12 2018 Uncategorized Leave a comment 21 Views Individual income tax in malaysia for audit tax accountancy in johor bahru rates irs announces 2018 tax brackets.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Introduction Individual Income Tax.

23 rows The amount of tax relief 2018 is determined according to governments graduated scale. The most up to date rates available for resident taxpayers in Malaysia are as follows. When you file your income tax this 2019 make sure to have a good hard look at your expenditure from the year before so you dont miss out on any tax relief you can claim for.

The 2018 national budget was announced by Malaysias Minister of Finance on 27 October 2017. About This Malaysian Personal Income Tax Calculator. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000 as follows.

More on Malaysia income. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. On the First 5000.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 250000 46900 245 400000 83650 25 600000 133650 26 1000000 237650 28. Nonresident individuals are taxed at a flat rate of 28. The 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. No guide to income tax will be complete without a list of tax reliefs. Youll be charged a flat rate on any taxable income of 28.

Assessment Year 2018-2019 Chargeable Income. Nonresident individuals are taxed at a flat rate of 28. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000 as follows.

Computation of Income Tax and Tax Payable 41 After ascertaining the chargeable income as explained in detail in PR No.

How To Calculate Foreigner S Income Tax In China China Admissions

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

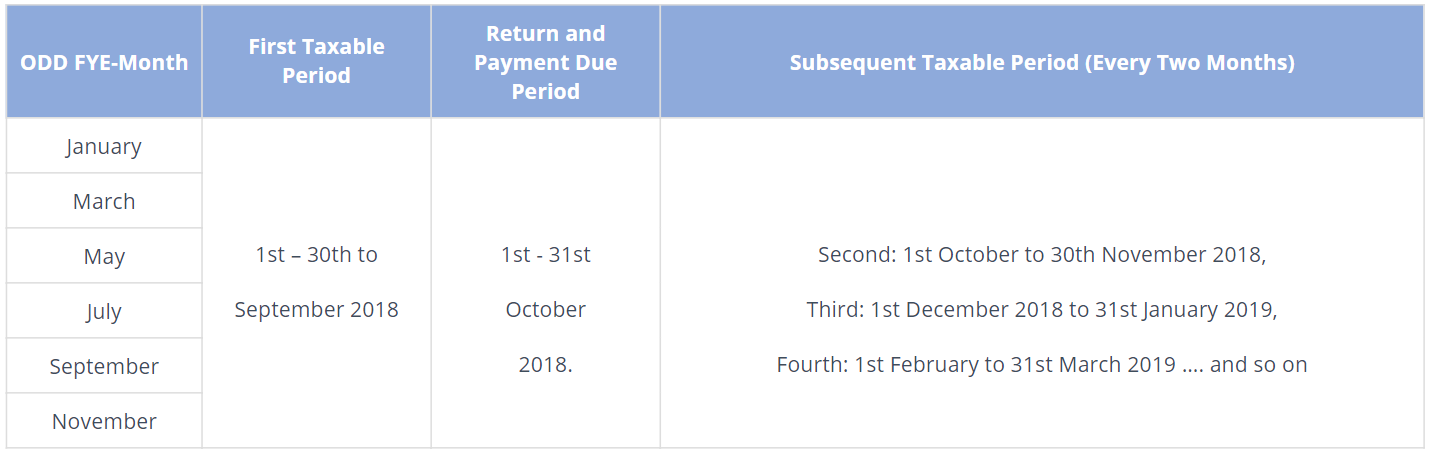

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysian Tax Issues For Expats Activpayroll

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

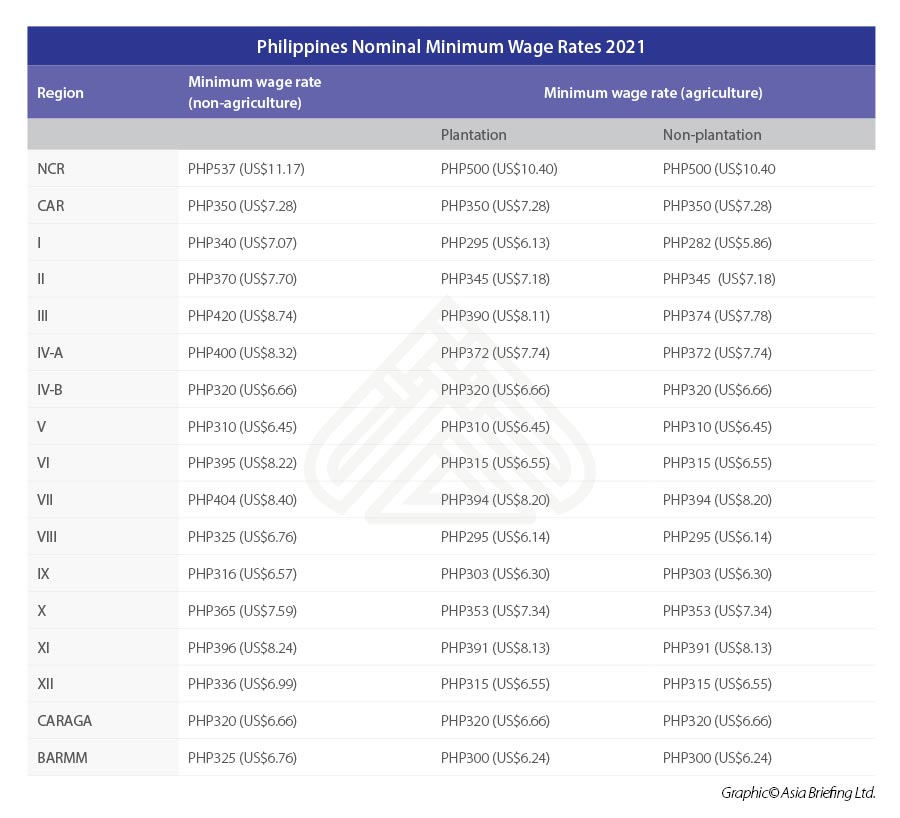

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Income Tax Malaysia 2018 Mypf My

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Minimum Wages In Asean For 2021

Why It Matters In Paying Taxes Doing Business World Bank Group

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Why It Matters In Paying Taxes Doing Business World Bank Group

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Gst In Malaysia Will It Return After Being Abolished In 2018